Financials Unshackled Issue 52 | Week In Review (Thoughts on SAN/TSB and Much More)

The INDEPENDENT voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

Welcome to Financials Unshackled Issue 52 | ‘Week In Review’ - your weekly pack for critique and curation of key banking developments over the last week. This is the first note in a couple of weeks due to laptop issues while travelling. It’s taking on a new format this week which I hope you like. Feedback, as always, is most welcome.

✂️ Executive Summary ✂️

🇬🇧 UK Unfiltered 🇬🇧

Santander announced on Tuesday evening that it has agreed to acquire TSB Banking Group plc from Sabadell for £2.65bn in an all-cash deal, i.e. 1.45x end-1Q25 TNAV. A big price relative to expectations but: i) a major cost extraction play; and ii) it strengthens Santander’s UK franchise. At one level it reinforces Santander’s stated commitment to the UK but, in my view, it also enhances optionality were Santander minded to pursue other possible M&A opportunities.

The findings of the latest BoE Credit Conditions Survey and Bank Liabilities Survey are broadly consistent with the messages conveyed by the banks at recent banking conference appearances and come as no great surprise. The outlook indicates: i) some marginal front book net interest margin (NIM) accretion; ii) further growth in retail deposit volumes; and iii) moderate growth in new lending in the three months to end-August.

The results of the BoE’s Money and Credit Statistics for May 2025 are broadly consistent with the findings of the BoE Credit Conditions Survey and Bank Liabilities Survey. The rise in mortgage approvals does indicate an improving housing market despite the recent changes to the stamp duty regime and the U-turn in approvals came sooner than economists expected.

There was a marginal decline in mortgage spreads last week. Average 2Y mortgage spreads are now at 72bps (-1bp w/w) and average 5Y mortgage spreads now sit at 62bps (-2bps w/w).

PAG’s CEO raised some interesting points over lunch with The Times - noting that credit quality “has been phenomenal”, management has a highly disciplined approach to risk management, and that PAG sees itself as a consolidator.

STB’s decision to quit new lending within its Vehicle Finance business and put the existing book into run-off seems an eminently sensible decision to enhance group returns.

And more below…

🇮🇪 Ireland Unvarnished 🇮🇪

The CBI’s Money and Banking Statistics for May 2025 point to continued positive conditions in both a loan growth and a deposit funding build context for the banking industry.

The State should move swiftly to start selling down its shareholding in PTSB. Indeed, a potential transaction could come in the relative near-term in my view given the recent surge in the share price. That would be constructive in the context of stock liquidity and would help broaden the investor base.

And more below…

🇪🇺 Europe Unbound 🇪🇺

German Chancellor Merz has dealt a hammer-blow to the EU’s Banking Union project flatly rejecting the idea of a joint European Deposit Insurance Scheme.

Bundesbank Executive Board Member favours capital regulation simplification: “If it was up to the Bundesbank, we could radically simplify the different capital buffers, ideally in a releasable and a non-releasable buffer”.

And more below…

🌎 Global Unpacked 🌎

Tether in the spotlight in The Economist 1843 Magazine, which delves into how the largest stablecoin by market capitalisation, is fuelling the rise of a global shadow economy.

To unshackle your understanding of the week's banking developments please read on to explore critiques, curated insights, your calendar for the week ahead, and to finish with some light entertainment!

🔎 The Critique 🔎

In this section I dissect the week’s most significant banking development(s) / theme(s) of interest across key regions as appropriate, cutting through the noise to get to the crux of the issue.

🇬🇧 UK Unfiltered 🇬🇧: Santander swoops on TSB

What Happened?: Santander announced on Tuesday evening that it has agreed to acquire TSB Banking Group plc from Sabadell for £2.65bn in an all-cash deal, i.e. 1.45x end-1Q25 TNAV. Sabadell notes that the final consideration is expected to be £2.88bn, including estimated TNAV build of £0.23bn between 1st April 2025 and the expected closing in 1Q26. The transaction remains subject to shareholder and regulatory approvals.

Some Detail: Santander intends to integrate TSB with its UK group and expects to generate a return on invested capital of >20%, thereby supporting accretion in RoTE for Santander UK from 11% in FY24 to 16% in FY28 (please consult Financials Unshackled Issue 46 here for a dissection of Santander UK Group Holdings plc’s RoTE computations - notably it does not strip out AT1 costs from the numerator) it says. Furthermore, Santander Group expects the transaction to be eps accretive from Year 1 and to drive c.4% eps accretion in FY28.

Why it Matters: 3 key reasons: 1) It, arguably, reaffirms Santander’s commitment to the UK only months following the media reports to the effect that the bank entertained discussions with Barclays (BARC) and NatWest Group (NWG) in relation to a potential sale. 2) It drives a substantial uplift in Sabadell’s capital base, with the bank noting that it estimates 409bps of CET1 augmentation from the deal, positioning it to announce an extraordinary cash dividend of c.€2.5bn. A boon for Sabadell’s shareholders amidst BBVA’s hostile pursuit of the lender (which BBVA is intent on proceeding with, according to this Bloomberg report on Friday). 3) It will, to an extent, reshape the UK competitive landscape amongst the ‘Big Six’ lender community and, arguably, sets a new anchor for UK bank valuations in M&A situations - with the price of 1.45x TNAV, given TSB’s 10.6% FY24 RoTE print (ok, I’m not sophisticating this assessment by seeking to calculate u/l RoTE, stripping out excess capital - but you get the drift and I’ve done plenty of dissection of the numbers in previous issues), marking a new bar in my view. And, arguably, high time for the sector-wide paranoia around being seen to overpay subsided - when there is, perhaps, much value to play for on a medium-term view. Santander has moved confidently forward ‘without looking over its shoulder’ - and saw its share price lift by 1.3% last week.

Unshackled Perspectives: 1) To state the obvious, it was a very big price relative to expectations in the City around what price TSB would fetch but this is a major cost extraction play. TSB management had been delivering in this context and Santander has further big ambitions in this vein, with at least £400m in pre-tax cost synergies targeted (c.13% of combined FY24 cost base and close to 50% of TSB’s FY24 standalone cost base) - justifying a stronger-than-may-have-been-expected multiple for the business. 2) This deal, to the extent it starts to deliver on the expected benefits, undoubtedly strengthens Santander’s UK franchise in a scale context. 3) So, does that mean it is now committed to the UK for the long-term? At one level, yes. But it also creates improved optionality. Could there be a wider play? Exploring this last point further, various permutations have been speculated in recent months following the media reports around a potential Santander divestment from the UK. For example (and in simplistic terms): i) would HSBC (HSBA) swap its Mexican business for the Santander UK business (Santander would surely seem an ‘acceptable’ acquirer)?; ii) would Barclays (BARC) swap its US cards business for the Santander UK business?; and iii) would Standard Chartered (STAN) look at an acquisition of Santander UK as a lever to cement a UK presence (indeed, the STAN CFO recently remarked that, given that its stock price has soared towards book value, acquisitions could be on the agenda - though an acquisition of Santander UK would clearly necessitate a rights issue)? The agreed acquisition of TSB doesn’t close these possibilities off - and could, in fact, make them even more possible prospects (which is not to suggest that a high probability should be attached to any of them). Additionally, BARC (given its stated ambition to reduce the proportionality of its Group RWAs attributable to the investment bank to c.50% by end-FY26) is likely to be sore that it didn’t succeed in its bid for TSB (NatWest Group (NWG) less so presumably given that its stated ambition to grow its penetration of UK customers in a mortgages and a cards context seems more organic-focused, i.e., NWG management acknowledges that it is not leveraging its existing primary customer accounts hard enough). Indeed, BARC’s IB business could be particularly attractive to Santander given the latter’s ambitions in this space. And BARC’s US Cards business has value as a hedge in the context of IB earnings volatility so maybe that could be attractive too. And, maybe BARC’s UK business is also attractive to Santander. But there would be other options too for the UK in any related ‘bulk-up’ scenario if you think it through. Ultimately, there are dozens of permutations in terms of how it could all yet shake out amongst the ‘Big Six’ - and nothing more might happen. But worth thinking about all the same. 4) On a final note, both banks already operate in highly competitive mortgage lending and deposit-taking markets - and I categorically do not expect any material disruption in a pricing context in either market.

Resources: Santander announcement here with link to analyst call; Santander presentation on the deal here; TSB announcement here; Sabadell announcement / presentation on the deal here; Sabadell press release on shareholder return intentions here; interview with Ana Botin, Executive Chair of Grupo Santander, in The Sunday Times here (which also, separately, briefly touches on her ambitions for Openbank, Santander’s digital bank initiative, which Botin notes will also come to the UK).

📌 The Curation 📌

In this section I collate select key banking developments across key regions, cutting through the noise to get to the nub of the issue in cases.

🇬🇧 UK Unfiltered - My Top Picks 🇬🇧

1️⃣ BoE surveys point to front book NIM accretion and further deposits growth

The Bank of England (BoE) published its quarterly Credit Conditions Survey here and its quarterly Bank Liabilities Survey here on Thursday. These cover the three-month period to end-May (which the BoE labels Q2 for convenience) and both surveys were conducted between 27th May and 13th June.

Key points from the surveys were:

Credit Supply: Credit availability to all segments grew in Q2 and is expected to grow again in Q3 (the three months to end-August).

Credit Demand: Demand for mortgages for house purchases grew in Q2 but is expected to decrease in 3Q with seasonal factors as well as the stamp duty regime changes likely to be at play here in my view (notably remortgaging demand grew in Q2 and is expected to increase further in Q3). Demand for unsecured lending grew in Q2 but is expected to reduce marginally in Q3. Demand for business lending was up slightly in Q2 and is expected to grow marginally further in Q3.

Credit Spreads: Mortgage spreads widened slightly in Q2 and are expected to be unchanged in Q3. Unsecured lending spreads narrowed in Q2 and are expected to narrow further in Q3. Spreads on business lending widened in Q2 and are expected to widen further in Q3.

Credit Defaults: Unchanged across the board in Q2 and expected to remain unchanged again in Q3. Notably, there was an increase in losses given default (LGDs) on mortgages (slightly) and large business loans in Q2.

Funding Volumes & Spreads: Total volumes increased in Q2 and are expected to rise further in Q3. Retail deposit funding volumes increased in Q2 and spreads also increased. Retail deposit funding volumes are expected to grow further in Q3 while spreads are expected to remain unchanged.

All in all the findings of the surveys are broadly consistent with the messages conveyed by the banks at recent banking conference appearances and come as no great surprise. The outlook indicates: i) some marginal front book net interest margin (NIM) accretion; ii) further growth in retail deposit volumes; and iii) moderate growth in new lending in the three months to end-August.

2️⃣ BoE reports a return to growth in net mortgage approvals in May:

The Bank of England (BoE) published Money and Credit Statistics for May 2025 here on Monday 30th June.

Key points to flag:

Net mortgage approvals back in growth territory: Net mortgage approvals for house purchases were +2,400 m/m to 63,000 in May (and remortgaging approvals were +6,200 m/m to 41,500 - the largest increase since February 2024), the first month in 2025 in which approvals grew.

Net borrowing in positive territory in the month: Net borrowing across mortgages (annual growth rate in net mortgage lending +2.6%), unsecured credit (annual growth rate in unsecured credit +6.5%), and business lending (annual growth rate in large business lending +8.4% and -0.2% for SMEs) all in positive territory in May.

Rates data: i) Mortgages (stock 3.87%, +1bp m/m; May flow 4.47%, -2bps m/m); ii) Interest-charging credit cards (21.54%, +9bps m/m), interest-charging overdrafts (22.28%, -7bps m/m), new personal loans to individuals (8.72%, +3bps m/m); iii) Business loans (May flow 5.60%, -79bps) - and within this were SME loans (May flow 6.54%, -25bps m/m).

Deposits: Household deposits +£4.3bn in the month with rates broken down as follows: i) new time deposits 3.92%, -10bps m/m; ii) stock of time deposits unchanged m/m at 3.61%; and iii) stock of sight deposits 1.96%, -3bps m/m. Business deposits +£4.6bn in May with rates broken down as follows: i) new time deposits 3.77%, -13bps m/m; and ii) stock of sight deposits 2.29%, -10bps m/m.

All in all the data is broadly consistent with the findings of the BoE Credit Conditions Survey and Bank Liabilities Survey. The rise in mortgage approvals does indicate an improving housing market despite the recent changes to the stamp duty regime and the U-turn in approvals came sooner than economists expected (with the pre-release consensus view amongst economists polled by Reuters pointing to a moderate further m/m dip in approvals in May to 59,750).

3️⃣ Mortgage spreads down marginally in the last week:

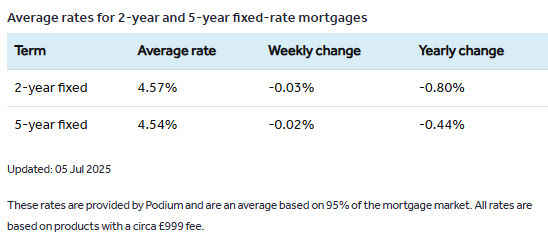

Rightmove’s latest Weekly Mortgage Tracker (published on Saturday 5th July here) shows that there was a marginal decline in mortgage spreads last week. The average 2Y and 5Y mortgage rates are shown in the table (extracted from the release) below, indicating that average 2Y mortgage spreads are now at 72bps (-1bp w/w) and average 5Y mortgage spreads now sit at 62bps (-2bps w/w). No point in overanalysing just one week of data but a useful tracker to keep an eye on nonetheless.

4️⃣ Other Sector Snippets:

The Bank of England (BoE) Prudential Regulatory Authority (PRA) published its Policy Statement on updates to the UK policy framework for capital buffers, PS8/25, on Thursday here. These updated Capital Buffers Regulations (CBR) come into effect on 31st July. The final policy is consistent with the proposals set out in CP10/24 so no late stage surprises here - and, just to refresh, the changes are relatively minor and relate to the PRA’s approach to both the G-SII and O-SII buffers identification and setting.

The Financial Ombudsman Service (FOS) published complaints data for 2024/25 (the year ending 31st March 2025) on Wednesday here. 305,726 complaints were received in the year, up 54% on the 198,798 complaints received the prior year. While a surge in motor finance commission-related complaints (+60,734 y/y to 73,328) partly explains the delta there was also a significant increase in complaints related to irresponsible / unaffordable lending (with credit card lending in particular focus here) as well as strong growth in complaints regarding frauds and scams. The claims upheld rate fell by 3pps y/y to 34%.

CityAM reported here on Thursday on the ‘DOGE-like cull’ of costs that has been observed across the UK banking market in recent times, which is set to continue to be a significant focus. I contributed my own high-level perspectives to the article as follows: “I expect that AI-driven efficiencies will serve to substantially trim cost bases in the years ahead. The main areas of focus are the automation of middle and back office tasks, AML and compliance support, and IT security. AI will also drive efficiencies in a sales and marketing context as well as serve to meaningfully speed up front office bankers’ analytical workloads.”.

5️⃣ PAG CEO raises some interesting points over lunch with The Times:

Good to read about the CEO of Paragon Banking Group (PAG) Nigel Terrington’s lunch with The Times here on Saturday. First and foremost the restaurant is a great choice - I have enjoyed dining in Hispania myself in the past which is great for a casual yet discrete chat!

So, into the detail:

Credit Quality: Terrington defends the landlord in response to Starmer’s (frankly ridiculous in my view) relatively recent casual assertion to the effect that landlords are not “working people”, noting that “If you’re a landlord, and this is your only business, that’s your job” - before going on to note that PAG’s credit quality “has been phenomenal” (I would add two pieces of data that help evidence this: a) PAG’s arrears are running at just a fraction of its closest peer’s (OSB) levels; b) PAG CoR peaked at just 34bps in PAG’s first charge book during the GFC – at a time when average LTVs were in the low 80%’s and base rates were considerably higher).

Risk Appetite: A comment made by Terrington that sums up PAG’s management ethos in my view is: “We were prepared to compromise the growth in the business to ensure it was safe” - shareholders have thanked PAG for this through the passage of time (notably PAG has sustained a premium market valuation (in terms of P/TNAV vs. RoTE) to its closest peer OSB for a long time.

M&A Ambitions: Terrington says “we definitely see ourselves as a consolidator, for want of a better word” - this has been a consistent comment for many years (Terrington made a lot of comments in this vein around five years ago too - and has done on and off since then) and, while PAG has been a serial acquirer over the years, nothing has happened for some time. So, maybe M&A beckons! Personally I don’t think OSB would be a great fit culturally (that said, there would be obvious quantitative benefits from a combination - especially if PAG ever gets IRB accreditation for its BTL book) - but maybe when there is clarity in a motor finance debacle context Close Brothers Group (CBG) could come into focus (cultural alignment, IRB synergies with development finance in mind). Just some thoughts. There are many other M&A possibilities - with the smaller unlisted specialist lending community in mind particularly. Anyway, the fact that Terrington, a typically quite private individual, is courting the mainstream media again (following this interview with The Sunday Times in late August 2023) might just suggest PAG could be eyeing up something or that legacy planning is gaining prominence.

6️⃣ STB announces strategic pivot; quitting Vehicle Finance new lending:

Secure Trust Bank (STB) issued an announcement on Wednesday 2nd July here noting that it has decided to quit new lending within its Vehicle Finance business and put the existing book into run-off. The announcement further notes that “On an unaudited pro forma basis, the impact to the Group's FY2024 financial results assuming a completed run-off and the cost actions outlined below, would be an uplift on adjusted profit before tax to £56.6m from £39.1m and an estimated 800bps increase to Group ROAE before any reinvestment of released capital from the Vehicle Finance business.”.

This seems an eminently sensible decision to enhance group returns and I would not be surprised to see some others follow, in the wake of clarity around the motor finance debacle perhaps (notably the Supreme Court judgment is expected this month). Some recent financial analysis I have done on RoRWAs by division across various lenders shows that motor finance risk-adjusted returns are a laggard - and, while credit rating agencies like the business for cashflow predictability reasons, that’s not necessarily a good enough reason to ‘stay in the game’. STB saw its shares up >5% in the last week (the abrupt move up in response to the announcement indicates shareholders were pleased with the decision).

7️⃣ Other Company Snippets:

Paul Davies at Bloomberg is well worth a read here on how the Barclays (BARC) CEO Venkat is coming under pressure to start demonstrating delivery in the context of the three-year plan given we’re now at its midpoint, pointing to consensus analyst scepticism on BARC management’s ability to achieve its IB cost targets in particular. Of course there are also question marks around whether BARC can achieve its target to reduce the proportionality of Group RWAs attributable to its IB business to c.50% by end-FY26 - and, as noted above, BARC will likely be sore that it was outbid for TSB in my view. Davies also picks up on two further important points, which will intensify competitive dynamics in the context of its IB activities: i) the impending changes to the US Leverage Ratio rules, which, he writes “…will mean American banks need less capital to trade in government debt and other bonds, or to lend to hedge funds, which has been a growth focus for Barclays”; and ii) the removal of the asset cap applicable to Wells Fargo (which was lifted on 3rd June).

Investors Chronicle published a detailed note on Funding Circle Holdings (FCH) here on Monday questioning whether the strong run in its share price can continue - picking up on positive sell-side analyst commentary in relation to the outlook for the business.

The Guardian reported yesterday here on how campaigners are kicking up a fuss in relation to Nationwide Building Society’s refusal to give members a binding vote on the intended pay rise for CEO Debbie Crosbie. Nationwide has never held a binding vote on pay and the Building Societies Act 1986 requires binding votes only for the election of members. For what it’s worth, my view is that you typically get what you pay for. Nationwide has taken on an energetic and strong leader who hasn't been afraid to move the organisation in an unorthodox direction - that’s someone you want to keep, not lose to a rival.

Various media outlets reported on Tuesday that Standard Chartered (STAN) is facing a lawsuit in Singapore’s High Court - with liquidators involved in Malaysia’s 1MDB debacle reportedly suing the bank for >$2.7bn. STAN has reportedly noted that the claims are “without merit”.

8️⃣ Shareholding Changes of Note:

Investec (INVP) announced on Tuesday 1st July that Mark Currie (Executive, Investment Banking Origination) sold 50,000 shares in INVP on 30th June at a price of 540.0p per share, netting him gross proceeds of c.£270k.

NatWest Group (NWG) announced on Friday 4th July that Norges’ shareholding in the bank reduced to 2.88% (previously disclosed shareholding: 3.01%) following a transaction on 3rd July.

OSB Group (OSB) announced on Monday 30th June that Clive Kornitzer (Group COO) sold 30,694 shares in OSB via a nominee account on 30th June at a price of 520.6p per share, netting him gross proceeds of c.£160k.

OSB Group (OSB) announced on Monday 30th June that GLG’s shareholding in the bank fell to <5% (previously disclosed shareholding: 5.65%) following a transaction on 26th June.

Paragon Banking Group (PAG) announced on Friday 4th July that JPM Asset Management’s shareholding in the bank increased to 5.72% (previously disclosed shareholding: 5.15%) following a transaction on 2nd July.

Secure Trust Bank (STB) announced on Friday 4th July that: i) Kiripaka Capital (PCA to Chair Jim Brown) purchased 3,525 shares in STB on 2nd July at a price of 848p per share, for a gross outlay of c.£30k; and ii) Mary Hartley (PCA to Julian Hartley, MD Savings & Vehicle Finance) purchased 13,847 shares in STB on 2nd July at a price of 862p per share, for a gross outlay of c.£120k.

🇮🇪 Ireland Unvarnished - My Top Picks 🇮🇪

1️⃣ CBI stats show continued strong growth in lending and deposits:

The Central Bank of Ireland published its Money and Banking Statistics for May 2025 here on Monday 30th June.

Key points to flag:

Loan Volumes: Mortgages for house purchases were +€240m in May 2025, continuing the positive trend observed since May 2024 - annual growth was €3.5bn to end-May, +4.2% y/y. Net lending to households was +€263m in May - annual growth to end-May was just over €4bn, +4.1% y/y. Net lending to non-financial corporates (NFCs) was +€84m in May - annual growth to end-May was €150m, +0.5% y/y.

Deposits: Household deposits were +€1.4bn in May to €165.3bn - with the growth primarily attributable to overnight deposits (good for liability margins). Annual growth in household deposits to end-May was €10bn (€6.7bn term, €3.1bn overnight), +6.5% y/y. NFC deposits were -€1.1bn in May (meaning net deposits growth in the month across household and business of +€0.3bn) - with the fall entirely driven by reduced overnight deposits. Annual growth in NFC deposits to end-May was -€2.2bn (+€1.1bn term, -€3.2bn overnight).

All in all the data is broadly as expected and points to continued positive conditions in both a loan growth and a deposit funding build context for the banking industry.

2️⃣ State should move to sell its shareholding in PTSB:

My latest column for the Business Post - published on Saturday here - argues that the government “…should now decisively sell down its PTSB stake. This divestment must proceed without undue delay, far more swiftly and boldly than its approach to the AIB exit.”. Apart from striking an agreement with AIB Group (AIBG) in relation to the potential purchase, by the bank, of the warrants issued to the Minister for Finance at the time of AIBG's IPO in 2017, the disposal of the State’s 57.4% shareholding in PTSB is the final step in the journey to a normalised banking system.

There is a danger, of course, that the price at which the last placing of PTSB stock was executed of 202.5 cent per share serves as an anchor for future transactions. Lots of factors can affect the share price and, as we saw with AIBG back in late 2017, missed opportunities to transact can stall the process for years. However, my own expectation is that, while the State may be looking to achieve a price of more than 202.5 cent per share in the next transaction, the Minister will value the expedient exit from its last legacy bank shareholding over maximising every last red cent on the exit journey. The run-up in the share price, to the extent that it is sustained or creeps up a bit higher points to a potential transaction in the near future in my opinion. That would be constructive in the context of stock liquidity and would help broaden the investor base. I also note in the article that NatWest Group’s NWG) 11.66% shareholding is, on my calculations, ‘in the money’ since early June (it appears to be valued at €115m in NWG’s FY24 accounts and its market value is now >€130m) - and, therefore, “…I strongly suspect that NatWest is poised for divestment, awaiting only the Irish government’s initiative” in the context of the shareholder cooperation agreement between the Finance Minister and NWG.

PTSB reports its interim results on 31st July.

3️⃣ Shareholding Changes of Note:

AIB Group (AIBG) announced on Friday 4th July that FIL’s shareholding in the bank fell to <3% (previously disclosed shareholding: 3.00%) following a transaction on 2nd July.

AIB Group (AIBG) announced last week that BlackRock’s shareholding in the bank increased to 9.48% (previously disclosed shareholding: 9.43%) following BlackRock’s acquisition of HPS Investment Partners (which completed on 1st July).

Bank of Ireland Group (BIRG) announced on Monday 30th June that Pzena has acquired a notifiable shareholding in the bank of 3.01% following a transaction on 25th June.

Bank of Ireland Group (BIRG) announced last week that BlackRock’s shareholding in the bank reduced to 5.60% (previously disclosed shareholding: 5.92%) following BlackRock’s acquisition of HPS Investment Partners (which completed on 1st July).

🇪🇺 Europe Unbound - My Top Picks 🇪🇺

1️⃣ Banking Union hits a stumbling block:

Bloomberg reported here on Thursday that German Chancellor Friedrich Merz remarked to an audience of German cooperative bank executives that he flatly rejects the idea of a joint European Deposit Insurance Scheme (EDIS): “Let me make this very clear: we’ve discussed deposit guarantee systems in Europe long enough..And there’s absolutely no reason to pool functioning liability systems at the member-state level within the EU”.

This is a hammer blow to the Banking Union project, which various ECB policymakers have been issuing hopeful comments in relation to for some time. I wrote in the Business Post on 15th December last about the key obstacle in an EDIS context that is political resistance, commenting that “This has already been evident in the case of the Unicredit/Commerzbank dialogue where German politicians have not been shy in terms of voicing their discontent”. To put it bluntly, Germans don’t want to pool their deposits with other member states that they see as less fiscally responsible. This is an enormous obstacle and, given Merz’s comments now, it suggests to me that Banking Union is now a pipe dream in a medium-term context. Fundamentally, at its core, the European Union is not a strong union and member state’s political interests often outflank the interests of the wider union. That doesn’t look like it’s going to change any time soon.

2️⃣ Bundesbank Executive Board Member favours capital regulation simplification:

Bloomberg reported here on Thursday that Michael Theurer, a member of the German Bundesbank’s Executive Board, sees a “big chance” to simplify banking regulations in Europe - adding that “If it was up to the Bundesbank, we could radically simplify the different capital buffers, ideally in a releasable and a non-releasable buffer”.

I have thought a lot over the years about why bank capital regulation is as complicated as it is. Whilst appreciating that Theurer’s comments are not very specific, the convoluted nature of bank capital regulation could of course be simplified enormously - and I also appreciate that, at first glance, this comment can appear amateur but I contend that it’s not. There is also a valid debate as to whether more transparency (e.g., P2G disclosure) would be beneficial though I can see the drawbacks too for banks, whose stability depends on the confidence of the public and markets. More thoughts on all of this in due course.

3️⃣ Other European Snippets:

ECB Supervisory Board Member Patrick Montagner gave an interesting speech on Tuesday on ALM risks at the 2025 SSM conference on asset liability management in Frankfurt (transcript here). Montagner picks up on a few interesting points:

ALM-related risks have risen: There has been an observable increase in ALM risks as the reversal of the interest rate tightening cycle has pushed some banks to extend the duration of their interest rate positions while reducing funding issuances in terms of size and maturity, exposing them to greater risks from unexpected changes in interest rates or credit spreads.

Banks’ modelling of interest rate and liquidity risks needs enhancement: In terms of banks’ management of IRBBB and liquidity risks, banks, in their modelling exercises, must “…consider sufficiently long and appropriate time series that cover different interest rate environments and market-wide and/or idiosyncratic stress” and “…should also consider overlays and additional levels of conservatism to account for forward-looking risk factors and other dimensions that models cannot capture”.

Banks and investors should get away from the notion that accessing ECB liquidity facilities is a stress signal: “…as excess liquidity is expected to sink to levels that will no longer be sufficient to meet the demands of the banking system, banks and investors should view standard ECB operations and facilities – such as the main refinancing operations – as tools to be used proactively in day-to-day liquidity management to maintain an appropriate balance between central bank deposits and collateral in liquidity buffers. In other words, supervisors will not view banks accessing ECB facilities as an indication of a lack of market access or a sign of stress.”.

The EU’s Single Resolution Board (SRB) published its Annual Report for 2024 on Monday last (press release here; report here) with improvements in crisis readiness a key achievement that the SRB calls out. The SRB also updated its solvent wind-down guidance for more proportionality and flexibility on Wednesday (press release here).

Significant risk transfers (SRTs) continue to be ‘in vogue’ with Bloomberg reporting here on Thursday that BBVA is sounding out investors for a SRT deal linked to a portfolio of c.€4bn of corporate loans (following the recent completion of two SRT deals linked to €3.5bn of consumer and project finance loans) while the news agency further reported here on Friday that Commerzbank is planning to issue a SRT linked to a portfolio of c.€2bn in corporate loans.

🌎 Global Unpacked - My Top Pick 🌎

1️⃣ Tether in the spotlight:

Stablecoins are all ‘the rage’ these days but one fascinating article I want to flag is a ‘long read’ in The Economist 1843 Magazine (published on Friday here) which delves into how Tether, the largest stablecoin by market capitalisation, is fuelling the rise of a global shadow economy. As the article coldly reports: “There aren’t many other products that are as useful to criminals, and as much of a threat to the financial system, that have been allowed to flourish with so little regulation”.#

For further reading on stablecoins, I suggest a Compliance Corylated article from Monday last here, which wraps up on the key messages emerging from the recent Stablecoins Unblocked conference in London - in particular, issuers agued strongly that regulators should decouple stablecoins from other cryptocurrencies when designing regulatory frameworks. Also, worth reading a Reuters report from Thursday here that picks up on the Amundi CIO’s concern that a surge in USD-backed stablecoins in the wake of the US’ GENIUS Act could cause a shift in money flows that destabilises the entire global payment system.

📆 The Calendar 📆

Look out for these in the week ahead:

🇮🇪 Tue 8th Jul (11:00 BST): Central Bank of Ireland Research Publication - Non-bank Lenders to SMEs: Sensitivity to Financial Conditions

🇬🇧 Wed 9th Jul (09:30-17:30 BST): UK Finance Annual Mortgage Conference 2025 @ Eversheds Sutherland, One Wood Street, London EC2V 7WS - I’m looking forward to representing SeaPoint Insights, speaking as well as participating in a panel discussion from 11:10-11:55 BST

🇬🇧 Wed 9th Jul (10:30 BST): Bank of England Financial Policy Committee Record and Bank of England Financial Stability Report

🇬🇧 Wed 9th Jul (11:00 BST): Bank of England Financial Stability Report Press Conference (will be streamed here)

🇮🇪 Wed 9th Jul (11:00 BST): Central Bank of Ireland Retail Interest Rates (May 2025)

🍺 The Closer 🍺

Before we get to the full Disclaimer, let’s wrap up on a light-hearted note with some entertainment!:

🇬🇧 Interesting to read in The Times last Monday here about a leaked recording of an internal call on which the Lloyds Banking Group (LLOY) COO Ron van Kemenade noted that the bank’s service towards its customers has “degraded” over the past weeks and months which is a function of “…probably ten to 15 years of underinvestment”, which he apparently likened to a house falling into disrepair. Oh dear. This is not what investors want to hear. Doubtful that CEO Charlie Nunn is too pleased with this leak in view of his comments on the LLOY FY24 earnings call back in February as follows: “…we've reinforced our efficiency position with an increased focus on end-to-end digitisation and the simplification of our technology estate. Our success…is a result of the transformation of the group's capabilities across people, technology and data. We've made great strides in this area, significantly increasing the hiring of key engineering talent and adopting new technologies to drive innovation, creating the platform for the next phase.”.

🇬🇧 Sad to see Chancellor Rachel Reeves shed a tear last week but was it all a genius play? The bond markets took immediate fright that she might not survive in post given Starmer’s (predictable?…) initial silence in response to a question as to whether she would remain in her seat. And then he had to do the inevitable - and announce that Reeves has his “full backing”. This surely cements her position for some time. Extremely unlikely it was premeditated to be fair but it’s always important to think twice about what can appear to be just reactive at first glance.

🇮🇪 On a macro note again it was entertaining to read the headline in the Department of Finance’s press release on the latest Exchequer returns on Thursday here: “Most taxes steady in first half of the year but corporation tax volatile; continued investment in public services and infrastructure – Ministers Donohoe & Chambers”. Did someone send a memo: ‘no upbeat headlines on corporation tax please; we’re under fire from overseas’? Not to mention ongoing government department lobbying efforts in a budget allocation context. Looking at the data, cumulative YTD corporation tax (CT) receipts (excl. CJEU payments) to end-June of €13.1bn were +7.4% y/y - more than the y/y growth in income taxes and VAT, though the CT outturn didn’t make the summary bullet points in the press release… As Brian Carey at The Sunday Times notes today here “Don’t tell Trump, but corporation tax haul could top €30bn”!

📰SeaPoint Insights / its founder getting media mentions again last week:

Have a great week! 🍨

⚠️ Disclaimer ⚠️

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.