Financials Unshackled Issue 48 One-Off Note: Nationwide First Glance & Starling Bank Reflections

The independent voice on banking developments - No stockbroking, no politics, no nonsense!

The material below does NOT constitute investment research or advice - please scroll to the end of this publication for the full Disclaimer

This is A ONE-OFF NOTE that was sent earlier this morning via email to my non-Substack FinsFlash (UK) distribution list - I occasionally send notes on key breaking developments on a timely basis to this list and maintain a separate FinsFlash (Ireland & Europe) distribution list too.

If you wish to be added to both lists (and all non-Substack Financials Unshackled distributions from other platforms out) please just reply ‘Y’ to this email / email me with ‘Y’ in the subject line at john.cronin@seapointinsights.com.

Just specify ‘UK only’ or ‘IRL/EUR only’ if you just want to be added to one of the lists for non-Substack Financials Unshackled distributions.

Thanks for reading Financials Unshackled - by John Cronin at SeaPoint Insights! Subscribe for free to receive new posts and support my work.

Nationwide full year results – first glance

Nationwide delivered a robust financial performance in FY24 (the 12 months to 31st March), printing record statutory profit before tax (PBT) of £2.30bn, up from £1.78bn in the prior year. The key underpin for the growth in profitability y/y was the £2.3bn gain on the acquisition of Virgin Money UK – partly offset by: i) a £456m Day 1 ECL charge on acquisition; ii) £367m of administrative expenses associated with the acquisition; and iii) a substantial uplift in member reward payments to £1.0bn (from £344m in the prior year). Indeed, Nationwide has emphasised the substantial benefits associated with the transaction beyond the immediate financial impact, including increased scale, business diversification, and funding synergies – and it will be interesting to tune into the 11:00 a.m. results call to learn more about what is in store for the wider business in the years ahead.

Underlying PBT came in at £1.85bn, which was -7.5% y/y – reflecting a y/y reduction of £195m in Nationwide u/l PBT (-9.7% y/y) and a positive contribution from Virgin Money UK of £44m. The reduction is not unexpected given rate developments et al. (and is considerably less than the 24% y/y reduction in u/l PBT reported at 1H24). Notably, u/l net interest margin (NIM) was broadly flat y/y at 1.55%, which implies a significant improvement h/h in 2H24. Nationwide sub-group costs were up by just 0.8% y/y on a like-for-like basis, which is below inflation levels and the statement points to robust asset quality with low and stable arrears rates.

Nationwide’s mortgage stock share grew to 16.2% from 12.3% reflecting the Virgin Money acquisition and there were strong member deposit inflows of £14.1bn in the period, taking outstanding balances to £207.4bn – supporting retail deposit market share of 12.2% (including £67.3bn of Virgin balances). Indeed, Nationwide (excl. Virgin Money) achieved its highest ever organic growth in mortgage lending and retail deposit volumes in FY24.

The business remains very strongly capitalised, with an end-FY24 CET1 capital ratio of 19.1%, which is reassuring from a credit investor standpoint.

The substantial profitability has supported record member value delivery of £2.8bn, including both member financial benefit and direct member rewards.

All in all, my initial assessment is that this is a positive update with record profitability achieved in the year.

Annual Report Link: https://www.nationwide.co.uk/-/assets/nationwidecouk/documents/about/how-we-are-run/results-and-accounts/2024-2025/2025-preliminary-results.pdf?rev=7176e95d2d2b43f6a04063a701fa0371

Starling Bank full year results – analysis

Starling Bank published results for the year to 31st March 2025 yesterday. Underlying profit before tax (PBT) of £280.6m (i.e., prior to the £29m regulatory fine and a £28m provision for BBLS loans which potentially did not comply with a guarantee requirement) was -6.8% y/y as the growth in operating costs (+21.3% y/y) significantly outpaced revenue growth (+5.1% y/y). Indeed, this revenue growth rate is flattered by a c.£25m reduction in fair value losses but some of the cost uptick is investment-related.

Stepping back, an examination of the Balance Sheet raises serious question marks in relation to the strategic direction of travel. Despite all the hype a few years ago when a solid case was made for an organically scalable UK credit institution, leveraging a low cost deposit franchise and a keen cost base (which I admittedly subscribed to as well), Starling’s deposits stood at just £12.1bn at 31st March 2025 – representing a growth rate of 10.0% y/y but: i) is off a very low base relatively speaking; and ii) was likely bolstered by the fact that Starling increased rates paid on its current accounts in the year. As an aside, higher funding costs drove a 22bps NIM reduction in the year to 412bps – despite a material uplift in asset yields.

What’s more, Starling delivered loan growth of just 2.9% y/y – which is broadly in the range of what the large incumbents are delivering in terms of annual growth. But, in Starling’s case its net loans stand at just £4.7bn compared to £466bn over at Lloyds Banking Group (LLOY) at the same date, for example – so Starling’s loan book grew by just over £100m in the 12 months to the end of March while LLOY churned out £17.7bn of growth over that same time period. As has been well-documented, Starling took on a disproportionate share of Covid-era guaranteed business loans, which are unwinding now at a rapid clip – acting as a meaningful brake on overall growth. But underlying growth volumes are hardly material in a broader market context.

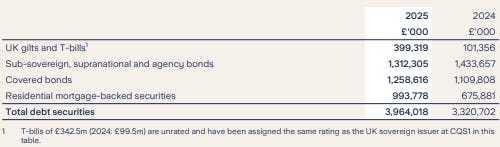

Indeed, Starling has moved up the risk curve to deliver lending growth (as its average loan asset yield of 6.75% in FY24 attests to) and is still struggling to recycle its deposits – with less than 30% of total assets represented by loans at year-end. While there are substantial cash balances sitting at central banks (£6.7bn), a further £3.9bn of (mostly excess) liquidity is sitting in investment securities with an average asset yield of 5.33% in the year – which Starling characterises as “low credit risk with credit ratings equivalent to the globally understood definition of investment grade”. It’s probably mostly high-quality stuff (see extracted table from p.129 of the Annual Report below) but it’s higher risk than Starling’s large bank peers would be running in these portfolios.

Starling has no choice but to move up the risk curve – and this isn’t something we learned today or yesterday either. Its limited scale and consequent lack of operating leverage, high risk weights (standardised credit risk modelling) and relatively higher deposit funding costs mean it just cannot compete with mainstream banks – as Metro Bank (MTRO) learned to its detriment in the later part of the last decade. But that cuts to the heart of the business model – what competitive advantages does Starling have?

It is important to ask what the true strategy is when valuation expectations in the region of £3-10bn have been touted over the last 12 months for a bank with a tangible equity position of just £1bn at year-end. OK, Starling did eke out a reported RoTE of almost 18% last year and it has a significant excess capital position – which was down substantially y/y due to one-off hits – but asset yields will come under pressure and impairment charges will rise in the years ahead. And what is the business model when less than 30% of total assets are represented by lending?

Starling has emphasised its growing SaaS revenue streams (Engine) seemingly in a bid to reposition ‘the investment case’ – and, arguably, in recognition of the fact that the core maturity transformation business scaling strategy hasn’t worked as intended (see a tech.eu article from April 2024 https://tech.eu/2024/04/29/engine-can-be-bigger-than-starling-says-boss-but-he-has-no-ambitoins/ and a This Is Money article from May 2024 https://www.thisismoney.co.uk/money/saving/article-13400561/How-Starling-helping-launch-banks-worldwide-taking-risk-free-slice-giving-access-software-Engine.html to learn more). But net fees and commissions came in at just £94.8m last year (i.e., <14% of revenues) and were only up by £10m y/y. That’s peanuts. Maybe we’ll see explosive growth in the years ahead as it’s a young initiative (and the bank is investing here, with growth in Engine employee costs a key underpin for the significant opex growth) – but, to put it mildly, the jury is out (see the comments in this FT piece https://www.ft.com/content/5dfcb0e9-f740-4a8f-b410-94fe5301713a from May 2024, for example).

While the jewel in the crown is the current account franchise it’s still doesn’t appear to be proving easy to grow non-interest bearing deposits in large quantities – and this despite its “unrivalled customer advocacy”. I had previously thought this business could deliver much more in terms of deposit growth and organic loan growth but the CEO’s soundbites about the business having a “tremendous platform and runway to grow in the UK” just don’t convince me these days. Unless it pursues a transformational acquisition of a specialist lender it’s hard to see what the ‘game plan’ is in a banking context. Indeed, a specialist lender could be a neat fit (pare back the expensive deposit funding, drive operating leverage, bring in proper lending and risk management experience) – but it all comes down to valuation and ensuring that the right bank management team is in place post-acquisition.

Annual Report Link: https://www.starlingbank.com/docs/annual-reports/Starling-Bank-Annual-Report-2025.pdf

Pillar 3 Disclosures Link: https://www.starlingbank.com/docs/annual-reports/Pillar3-2025.pdf

Disclaimer

The contents of this newsletter and the materials above (“communication”) do NOT constitute investment advice or investment research and the author is not an investment advisor. All content in this communication and correspondence from its author is for informational and educational purposes only and is not in any circumstance, whether express or implied, intended to be investment advice, legal advice or advice of any other nature and should not be relied upon as such. Please carry out your own research and due diligence and take specific investment advice and relevant legal advice about your circumstances before taking any action.

Additionally, please note that while the author has taken due care to ensure the factual accuracy of all content within this publication, errors and omissions may arise. To the extent that the author becomes aware of any errors and/or omissions he will endeavour to amend the online publication without undue delay, which may, at the author’s discretion, include clarification / correction in relation to any such amendment.

Finally, for clarity purposes, communications from Seapoint Insights Limited (SeaPoint Insights) do NOT constitute investment advice or investment research or advice of any nature – and the company is not engaged in the provision of investment advice or investment research or advice of any nature.